1099-r box 16 state distribution blank We would like to show you a description here but the site won’t allow us. The purpose of the junction box is to provide a centralized and organized system for managing the telephone wiring within a home. It allows for easy troubleshooting and maintenance, as any issues with the telephone network can be addressed at the junction box.

0 · internal revenue service 1099 r

1 · gross distribution on 1099 r

2 · form 1099 r worksheet

3 · form 1099 r instructions 2021

4 · form 1099 r 2021

5 · 1099 taxable amount not determined

6 · 1099 r taxable amount

7 · 1099 r form pdf

Apr 21, 2019

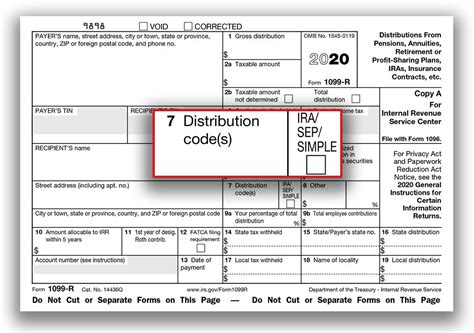

If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16.

waterproof junction project box

If your Form 1099-R does not have an amount in box 16 for a state distribution, .TurboTax is here to make the tax filing process as easy as possible. We're .Find TurboTax help articles, Community discussions with other TurboTax users, .

internal revenue service 1099 r

We would like to show you a description here but the site won’t allow us. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .

If Box 14 shows State Tax withheld, the Distribution Amount (Box 1) should be entered in Box 16. If no state tax was withheld, you can delete the State ID number , so that .For a distribution of excess contributions without earnings after the due date of the individual's return under section 408(d)(5), leave box 2a blank, and check the “Taxable amount not . His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement .Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.

gross distribution on 1099 r

form 1099 r worksheet

For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a .

In Jan'24, we received 1099-R for Traditional and Roth IRA, and noticed that the address is still California, Box 15 says CA with the payer's state number. Box 14 is blank (no state tax .

On my 1099-R the bank shows state distribution on line 16, which is not correct because I live outside of US since several years which they always knew. For example I had .

When preparing taxes, it asks for the state distribution amount from box 16. It will not let you move forward without entering a number. What do you place there?If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State . If Box 14 shows State Tax withheld, the Distribution Amount (Box 1) should be entered in Box 16. If no state tax was withheld, you can delete the State ID number , so that Boxes 14, 15 and 16 are blank.

For a distribution of excess contributions without earnings after the due date of the individual's return under section 408(d)(5), leave box 2a blank, and check the “Taxable amount not determined” box in box 2b. His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement income was not taxable at state level?

Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a may be taxable earnings on an excess contribution. Loans treated as distributions.

In Jan'24, we received 1099-R for Traditional and Roth IRA, and noticed that the address is still California, Box 15 says CA with the payer's state number. Box 14 is blank (no state tax withheld), Box 16 is also blank. On my 1099-R the bank shows state distribution on line 16, which is not correct because I live outside of US since several years which they always knew. For example I had also withdrawn in 2021 and that field (line 16) was (correctly) empty in my 1099-R as I was living outside of US in 2021 too.When preparing taxes, it asks for the state distribution amount from box 16. It will not let you move forward without entering a number. What do you place there?

If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16.

form 1099 r instructions 2021

If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State . If Box 14 shows State Tax withheld, the Distribution Amount (Box 1) should be entered in Box 16. If no state tax was withheld, you can delete the State ID number , so that Boxes 14, 15 and 16 are blank.For a distribution of excess contributions without earnings after the due date of the individual's return under section 408(d)(5), leave box 2a blank, and check the “Taxable amount not determined” box in box 2b. His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement income was not taxable at state level?

Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.

For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a may be taxable earnings on an excess contribution. Loans treated as distributions.In Jan'24, we received 1099-R for Traditional and Roth IRA, and noticed that the address is still California, Box 15 says CA with the payer's state number. Box 14 is blank (no state tax withheld), Box 16 is also blank. On my 1099-R the bank shows state distribution on line 16, which is not correct because I live outside of US since several years which they always knew. For example I had also withdrawn in 2021 and that field (line 16) was (correctly) empty in my 1099-R as I was living outside of US in 2021 too.

form 1099 r 2021

An electrical junction box (also known as a "jbox") is an enclosure housing electrical connections. [1] Junction boxes protect the electrical connections from the weather, as well as protecting people from accidental electric shocks.

1099-r box 16 state distribution blank|form 1099 r 2021