box 7 distribution code 7d We would like to show you a description here but the site won’t allow us. Showing modern septic system design and discussing how a distribution box functions. This will help explain something that is usually hiding from sight. Modern systems in our area are now.

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

Sheet metal thickness gauges for steel are based on a weight of 41.82 pounds per square foot per inch of thickness. This is known as the Manufacturers’ Standard Gauge for Sheet Steel. For galvanized material, the decimal by gauge and weight per pound is .

pension distribution codes

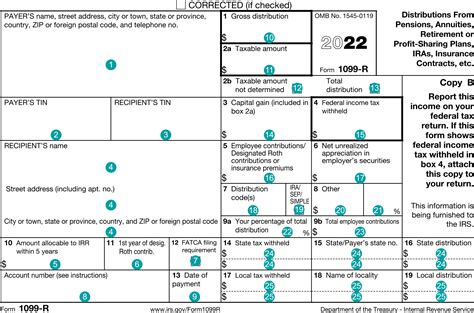

Box 7 is used to report income to you. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D is the new 'nonqualified annuity .Box 7 is used to report income to you. The different codes within box 7 tell what the .May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as .

Find TurboTax help articles, Community discussions with other TurboTax users, .We would like to show you a description here but the site won’t allow us.

5h sheet metal fabrication co

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not .

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498 Instructions on how to enter Form .Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to .If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

Box 7 is used to report income to you. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding andUse Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498 Instructions on how to enter Form 1099-R on your tax return

Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7.If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

irs roth distribution codes

irs pension distribution codes

Box 7 is used to report income to you. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding andUse Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498 Instructions on how to enter Form 1099-R on your tax returnUse Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7.

58.4-in x 34-in 6-drawer ball-bearing steel tool cabinet red

Junction boxes join multiple wires and are used in residential and commercial spaces for organization and code compliance. Choosing the Right Electrical Box for Your Project. Selecting the appropriate electrical box depends on several factors, including construction, wiring method, devices, location, and safety. Type of Construction

box 7 distribution code 7d|1099 r 7d distribution code